In El Cerrito, consultants don’t just provide professional services—they provide reassurance. And for a city in financial distress, that comfort has become dangerously convenient.

At the May 20, 2025, City Council meeting, NHA Advisors—El Cerrito’s longtime financial consultants—blamed CalPERS investment performance for the city’s soaring $89 million pension liability. But that narrative ignores reality. Nearly every city in California is affected by CalPERS investment returns. Yet few cities of El Cerrito’s size carry a severe pension burden.

The real issue isn’t the pension system—it’s El Cerrito’s choices. And the consultants who validate them.

A System That Reinforces the Status Quo

Consultants like NHA Advisors rely on small cities like El Cerrito for revenue. These cities often lack in-house financial capacity, making them easy long-term clients. But retaining the client often means reinforcing the client’s worldview. In El Cerrito’s case, that means avoiding tough truths about staffing models, spending priorities, and governance habits.

Rather than advise meaningful reform, consultants deliver affirming reports. They soften findings, minimize urgency, and present a picture of “strategic progress”—all while the city’s finances deteriorate in plain sight. In short, they have no credibility. The NHA presentation was akin to having your spouse provide an alibi.

The Data Tells a Different Story

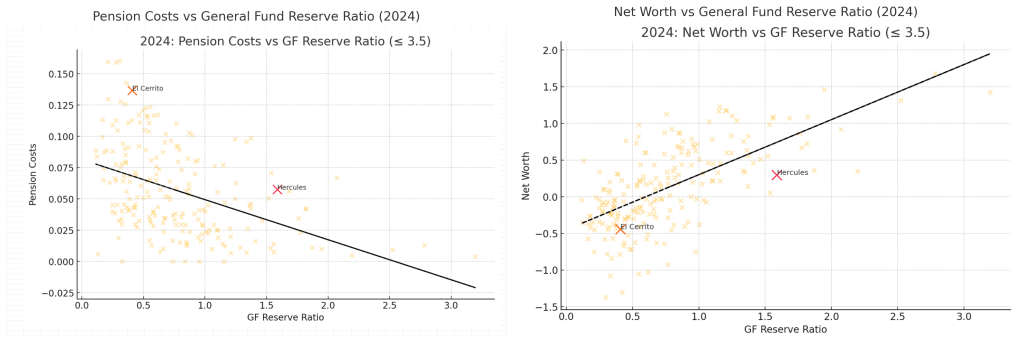

Two graphs from 2024 show just how far El Cerrito has veered from sound financial management:

Source: https://californiapolicycenter.org/fiscal-health-dashboard/#el-cerrito

Pension Costs vs. General Fund Reserve Ratio (2024)

El Cerrito is a stark outlier—saddled with high pension costs and among the lowest General Fund reserve ratios in the state. Compare this with a city of similar size and population, Hercules, which maintains moderate pension costs and a much healthier reserve position. The trendline is clear: higher reserves are associated with more manageable pension costs. El Cerrito breaks this trend in the worst way possible.

Net Worth vs. General Fund Reserve Ratio (2024)

Here, El Cerrito again appears in the bottom left—low reserves, negative net worth. This is not a technicality. It is a financial red flag. And yet, NHA and other city paid consultants continue describing El Cerrito’s fiscal posture as “strategic” and “resilient.”

The Section 115 Misdirection

One of the city’s supposed bright spots—the creation of a Section 115 Pension Trust—has also been mishandled. El Cerrito deposited $1.4 million into the trust but chose a highly conservative investment strategy. The result? The return was roughly half of what CalPERS would have generated. Most other cities using Section 115 funds are in surplus positions and invest more aggressively. El Cerrito is not in that category. Yet again, consultants downplay the consequence.

Conclusion: Stop Paying for Permission

El Cerrito’s consultants keep the city comfortable. They allow it to believe that nothing drastic needs to change. That higher taxes, vague plans, and polished slide decks will eventually solve deep structural problems. But the graphs, the rankings, the outcomes—they all say otherwise.

Until El Cerrito stops paying for affirmation and starts demanding accountability, the city will remain stuck. And its residents will keep footing the bill.