El Cerrito residents now pay among the highest tax rates in the region, yet services continue to lag and inefficiencies persist.

Now, as we transition our focus to the captivating concept of Fiscal Responsibility, we unravel the complexities and overlooked ramifications of self-governance gone awry. This edition of our blog sharpens its lens on a critical issue: El Cerrito’s reliance on excessive staffing, consultants, and—above all—new taxes to balance the books. Residents deserve transparency, accountability, and efficiency. Instead, they face the spiral of excessive spending and perpetual taxation.

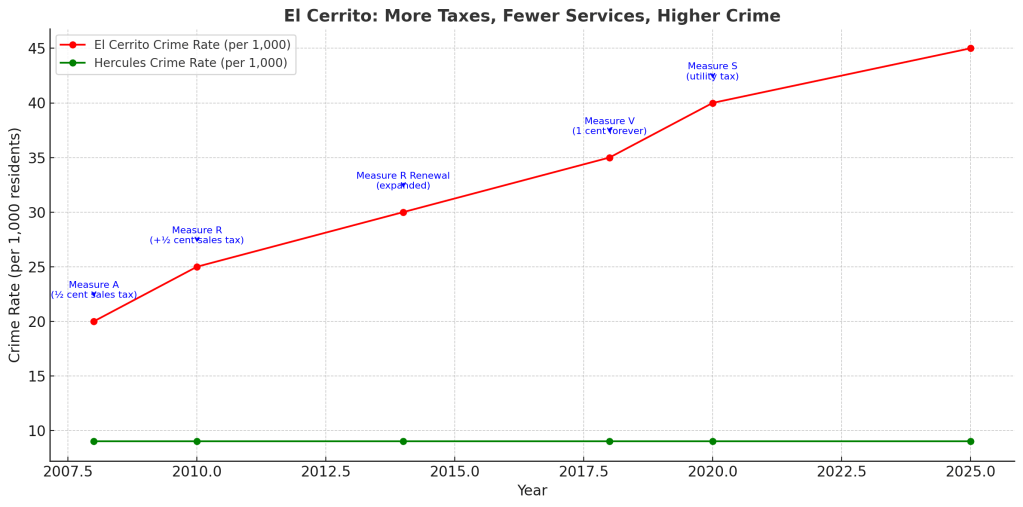

El Cerrito is paying double the cost of Hercules, more taxes and fewer services:

El Cerrito’s Staffing Problem

Residents are increasingly concerned about how the city is managed, especially when compared to nearby Hercules. Despite being smaller in both area and population, El Cerrito employs more than twice the staff of Hercules. Yet fully staffed departments still lean heavily on costly consultants to perform fundamental tasks—charging residents double for the same service. This disconnect between staffing levels and results raises hard questions: Has El Cerrito ever truly right-sized its workforce? Why are residents paying for both employees and outside contractors while crime increases and services lag?

The Tax Spiral: 2008–Today

Since 2008, El Cerrito has repeatedly returned to voters with tax measures rather than implementing real reform:

- 2008 – Measure A: A half-cent sales tax increase pitched as “temporary” to stabilize finances.

- 2010 – Measure R: Another half-cent sales tax added just two years later, doubling the city’s special sales tax burden.

- 2014 – Measure R (renewal): Extended and expanded the 2010 tax, making what was supposed to be temporary effectively permanent.

- 2018 – Measure V: Converted the earlier taxes into a “forever” one-cent sales tax, locking El Cerrito into one of the highest combined sales tax rates in the Bay Area.

- 2020 – Measure S: Extended the city’s utility users tax, adding further burden on residents’ monthly bills for electricity, gas, water, and telecommunications.

- Proposed – $300 Parcel Tax: A new flat parcel tax on every property owner, escalating over time, with no sunset clause.

We are already overtaxed, yet services have declined. Over the same period, residents have watched as the city closed facilities on alternating Fridays, reduced recreation offerings, cut library and senior services, and failed to maintain basic infrastructure. Crime has escalated as well, with auto burglaries, thefts, and assaults climbing even as residents pay more each year. In short, the community is being asked to pay more for less.

Crime Rates – El Cerrito vs. Hercules

- El Cerrito: Violent crime ~ 5 per 1,000; property crime ~ 40 per 1,000. That’s a combined rate of ~ 45 per 1,000 residents.

- Hercules: Violent crime ~ 2 per 1,000; property crime ~ 7 per 1,000. Combined rate of ~ 9 per 1,000 residents.

- Bottom Line: El Cerrito residents face a crime rate five times higher than Hercules, despite paying higher taxes.

Fully Staffed + Consultants = Inefficiency

Information Technology: Despite having a funded IT department, the city outsources essential functions, including infrastructure management, support, and even basic data security. Strategic planning and network management remain neglected.

Finance: The Finance Department struggles with budget preparation, transparency, and accuracy because the city spent residents’ dollars on a budget system that the city doesn’t utilize.

Outsourced financial analysis hasn’t been meaningfully integrated into city planning. Misrepresentations in reports—such as comparing annual budgets with quarterly figures—suggest either incompetence or an intent to mislead.

A Tale of Two Cities: Hercules vs. El Cerrito

In 2011, Hercules was on the brink of collapse. Through disciplined management, it rebounded—earning a 73.29 score from the State Auditor. El Cerrito, by contrast, languishes at 47.29 and firmly in the red zone. The difference? Governance and accountability.

Even more startling – Hercules has both a senior center and a state-of-the-art library, while El Cerrito insists the only way toward better services is through increased taxes.

While it’s true that the city’s financial health has improved in recent years, let’s not forget that El Cerrito is still among the highest-risk cities for bankruptcy in the state. More importantly, the city’s decline occurred during the city manager’s tenure as assistant city manager and since 2018 as city manager.

Just Not True

El Cerrito claims physical responsibility because of the new A bond rating. The truth is that El Cerrito remains in the bottom 20% of California cities. That’s still high risk and not good enough. El Cerrito must choose: continue burdening residents with escalating taxes while avoiding tough decisions about staffing and efficiency, or follow Hercules’ lead—embracing transparency, accountability, and right-sizing to deliver services without perpetual tax hikes. The cost of mediocrity is not just higher taxes. It’s poorer services, eroded trust, and a declining quality of life.

Your Voice Matters

What are your experiences with city services in El Cerrito? Have you felt the impact of higher taxes without better results? Share your story. Here’s how you can help: Share this post with other residents. Comment and add your perspective. Speak up at City Council meetings (note: public comment is now restricted to in-person attendees). Attend the Financial Advisory Board meetings in person, as they are no longer recorded. Post on Nextdoor or Reddit El Cerrito. Together, residents can demand a city government that respects both its people and their pocketbooks.

Contact info:

Mayor Carolyn Wysinger – cwysinger@ci.el-cerrito.ca.us

- Mayor Pro Tem Gabe Quinto – gquinto@ci.el-cerrito.ca.us

- Councilmember Lisa Motoyama – lmotoyama@ci.el-cerrito.ca.us

- Councilmember Rebecca Saltzman – rsaltzman@ci.el-cerrito.ca.us

- Councilmember William Ktsanes – wktsanes@ci.el-cerrito.ca.us

- City Clerk – cityclerk@ci.el-cerrito.ca.us (for inclusion in the council packet.)