Tomorrow, January 20, the City Council will accept certification of the Citizens Initiative Petition for the El Cerrito Library Initiative and, in the same meeting, present a Library Facility Update.

That alone should give residents pause.

As you’re pausing, consider this: None of those discussions change the core reality.

This initiative creates a permanent parcel tax—a forever tax—one that the City Council can raise without property owners consent.

An Interesting Scenario, Indeed

Isn’t this an interesting scenario?

We are having a public meeting about the library—its condition, its future, and multiple possible options—while City Council members and the City Manager have said all along that they are not involved in the initiative.

And yet:

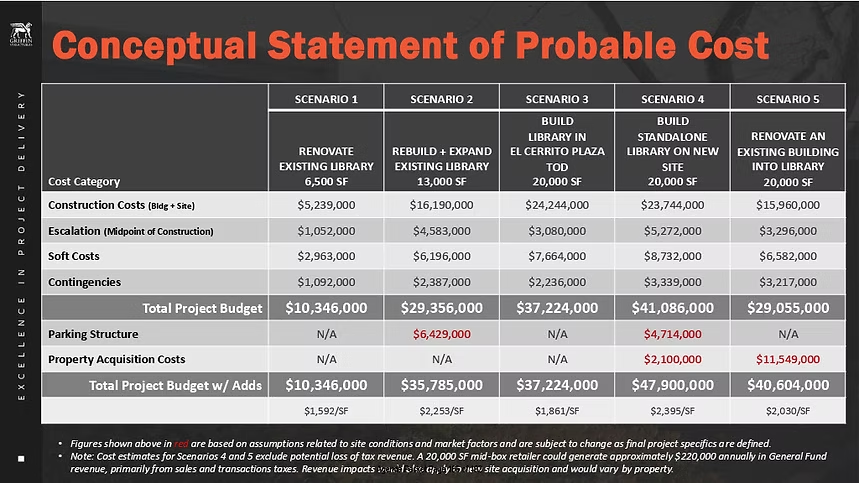

- The City is presenting cost ranges

- The City is outlining scenarios

- The City is recommending the next steps

- The City is proposing a future Library Task Force

All while a tax initiative tied to that same library is already qualified for the ballot.

If City leadership truly has no role in the initiative, why is the City now shaping the conversation around costs, options, and process for the very project the initiative is designed to fund?

That contradiction matters.

The Process Is Flexible. The Tax Is Not.

Staff is recommending a community-based process, including the appointment of a Library Task Force as early as spring 2026, to discuss options and refine cost estimates.

But none of those discussions change the core reality.

This initiative creates a permanent parcel tax—a forever tax—one that the City Council can raise.

If the initiative passes in June, the tax begins in December—well before a library could be designed, permitted, funded, or built under any of the scenarios being discussed.

Residents will start paying while the City is still talking.

Follow the Money

We also know what happens when revenue reaches City Hall.

Once collected, money enters the City’s broader fiscal system—subject to competing priorities, budget pressures, and internal tradeoffs. In the absence of enforceable guardrails, as we have seen before, funds are not immune from being blended into the same financial structure as other revenues.

Promises made before the money arrives are easy. Accountability after the fact is much harder.

That is why the order of decisions matters.

Call to Action: Questions Residents Should Be Asking

Whether you choose to speak at tomorrow night’s meeting, submit written comments, or simply observe, residents should pause and ask themselves a few fundamental questions:

- Will any of the library options being discussed actually change the tax initiative already headed to the ballot?

- If so, how—specifically and in writing?

- If not, why is public participation being framed as meaningful when the most consequential decision—the tax itself—has already been locked in?

- Why should residents trust assurances from leaders who have repeatedly distorted facts, withheld underlying assumptions, and misled the very people they are supposed to serve?

- Am I comfortable approving a permanent parcel tax that begins collecting in December, months before a library could realistically be built under any scenario?

- If costs rise, timelines slip, or priorities change, who ultimately bears the risk: the City or residents?

These are not questions about whether libraries matter. There are questions about governance, credibility, and accountability.

Once a forever tax is in place, the leverage shifts permanently to property owners.

And when trust is demanded instead of earned, Napoleon is always right.

Share This With Your Community

If you found this analysis helpful, please share it on social media and send it to friends, neighbors, and family who live in El Cerrito.

These decisions affect every household in the city—and informed conversations only happen when information is shared.