El Cerrito residents are being asked to approve another permanent tax — again. This time it’s wrapped in the language of libraries and community investment. But the real driver isn’t a building. It’s a budget that is being steadily consumed by pension costs, City leadership has failed to confront.

El Cerrito residents are being told the City needs another permanent tax — this time framed around the library. But this is not really about books, buildings, or community space.

It is about a cost structure that City leadership has refused to fix.

For FY 2024–25, El Cerrito adopted a General Fund operating budget of approximately $52.3 million. Before a single service is delivered, a massive portion of that budget is already spoken for.

FACT BOX: EL CERRITO PENSION COSTS & BUDGET IMPACT

FY 2024–25 – Minimum Required Pension Payments

• Baseline annual CalPERS pension costs: $8.56 million

– Normal cost for current employees plus required pension components embedded in CalPERS rates

• Required annual UAL payment: $6.9 million

– Mandatory annual payment toward the unfunded actuarial liability

• Total minimum annual pension payments: $15.46 million

What Percentage of the Operating Budget Is This?

• General Fund operating budget: $52.3 million

• Annual pension payments: $15.46 million

Pension costs consume approximately 29.6% of the General Fund operating budget.

In plain terms: nearly 3 out of every 10 operating dollars go to pensions before paying for police, fire, street maintenance, parks, libraries, planning, or basic customer service. And it’s the real reason why there’s no senior center.

These Costs Are Additive — and Mandatory

The City will pay at least $8.56 million every year in baseline pension costs. In addition, it must make a required $6.9 million annual UAL payment.

These are not alternative costs. They are cumulative. And they must be paid every year.

Prepaying the UAL may reduce interest costs, but it does not eliminate future pension obligations. Unless staffing levels change, these costs continue to grow automatically.

This is not a revenue problem. It is a cost-structure problem.

Instead of fixing what’s broken, the City keeps raising taxes—making El Cerrito less affordable for the people who already live here and less attractive to anyone considering buying a home, especially when entry costs like the Real Property Transfer Tax keep climbing.

When nearly 30% of the operating budget is locked into pensions:

• Flexibility disappears

• Services erode

• Maintenance is deferred

• Taxes become the default solution

Raising taxes without fixing the cost structure only pushes the bill onto residents.

This Is Why They’re Pushing Another Forever Tax

This tax push is not really about the library. The library can be improved for a fraction of the proposed tax measure through renovation, phased upgrades, or targeted capital investment. That option exists. It always has.

But modest library improvements do not solve a structural operating gap.

A permanent tax that can be increased at any time does solve their structural problem.

When pension costs consume nearly one-third of the operating budget — and staffing levels remain untouched — City leadership is left with a choice:

• Fix the cost structure, or

• Close the gap on residents’ backs

They have chosen the second.

Using the library as emotional cover to pass a forever tax is not leadership. It is avoidance.

Similar to previous taxes, they entice us with promises of desired projects such as a library, a senior center, reduced crime, and fire prevention, but in the end we receive none of what was promised. The money goes to cover pension costs.

El Cerrito Has Real Options — But Leadership Must Choose Them

Option 1: Rightsize Staffing Levels

Staffing levels, compensation, and classifications drive pension costs. If the City wants long-term stability, staffing must align with service demand, peer cities, and what residents can afford.

Option 2: Use the Improved Bond Rating Responsibly

The City’s improved bond rating can buy time — but only if paired with permanent cost corrections. Bonding cannot replace discipline.

The Bottom Line

- This tax is not about books.

- It is not about buildings.

- It is about closing budget gaps on your back.

CALL TO ACTION

Residents should contact City Council and the City Manager and ask:

1. Why are nearly 30% of General Fund operating dollars committed to pension payments?

2. What staffing changes are planned to slow future pension growth?

3. Why is a permanent tax being proposed instead of structural reform?

CITY CONTACT INFORMATION

City Manager’s Office

citymanager@el-cerrito.org | (510) 215-4300

City Council

Mayor Gabe Quinto – gquinto@ci.el-cerrito.ca.us

Councilmember Lisa Motoyama – lmotoyama@ci.el-cerrito.ca.us

Mayor Pro Tem Rebecca Saltzman – rsaltzman@ci.el-cerrito.ca.us

Councilmember William Ktsanes – wktsanes@ci.el-cerrito.ca.us

Councilmember Carolyn Wysinger – cwysinger@ci.el-cerrito.ca.us

Budgets reflect priorities. If residents do not demand better, the answer will always the same: pay more taxes, get less.

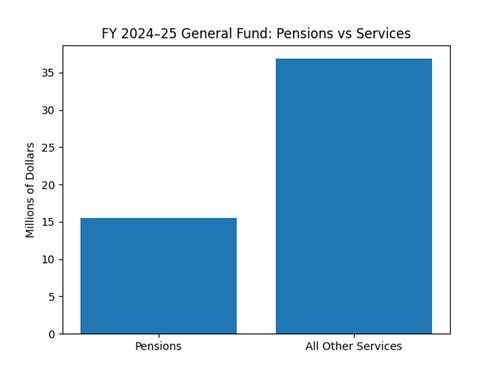

Pensions vs Core City Services

This chart shows how much of El Cerrito’s FY 2024–pension obligations consume 25 General Fund before services are delivered.

Library Myth vs Budget Reality

MYTH: The City needs a permanent tax to fund a better library.

REALITY: The library can be improved for a fraction of the proposed tax through renovation, phased upgrades, or targeted capital investment.

MYTH: This tax is about community amenities.

REALITY: The tax provides permanent revenue to backfill operating budget gaps caused by pension costs consuming nearly 30% of the General Fund.

This is not a revenue problem. It is a cost-structure

Instead of fixing what’s broken, the City keeps raising taxes—making El Cerrito less affordable for the people who already live here and less attractive to anyone considering buying a home, especially when entry costs like the Real Property Transfer Tax keep climbing.