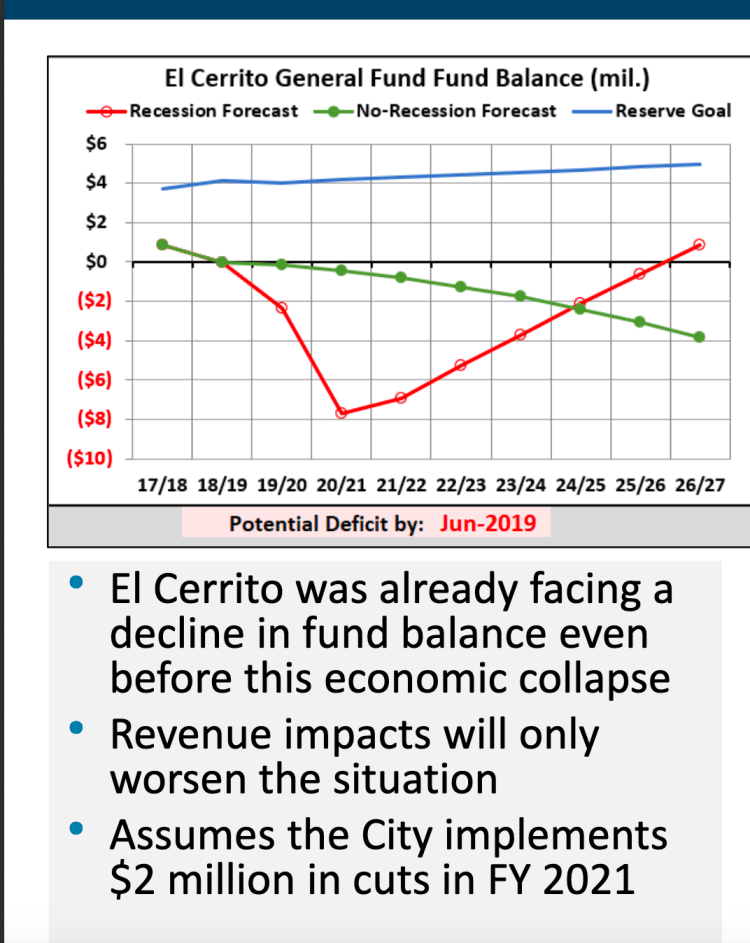

El Cerrito is in the midst of a major financial crisis. In October 2019 the State Auditor stated that El Cerrito was #7 on the list of CA cities most likely to go bankrupt. The issue was so serious that the auditor got state approval to do a full audit of El Cerrito. Unfortunately due to COVID-19 the audit is currently on hold. If you read the City Manager’s reports you would think that prior to COVID-19, the city’s finances were smooth sailing. While COVID-19 certainly exacerbated an existing problem, the problem with El Cerrito’s financial issues is long standing.

After reviewing the Comprehensive Annual Financial Reports, The Memorandum of Internal Controls (MOIC), City Council Meeting Minutes, and press coverage from the last decade, we see a City that fails to analyze and anticipate the outside threats to City finances, or chooses to simply ignore them.

We have identified four issues that warrant further analysis.

They are

- Staff not competent with governmental budgeting

- Interfund Borrowing

- No long term planning by staff

- Belief that staff wages need to be high for staff retention

These posts are meant to give us additional depth to this crisis but the issues we have identified are not the only issues. This will be part one of the post and part two will cover the second two issues.

STAFF NOT COMPETENT WITH GOVERNMENTAL BUDGETING

Looking at past audits, clearly the staff were not experienced with governmental budgeting, having a particularly hard time when revenues were on the decline.

EVIDENCE

There is a document called the Memorandum on Internal Control and Required communications. (MOIC) This report is one that the auditor prepares as a part of the Comprehensive Financial Report (CAFR) every year. What has become clear in reviewing them is that the city has been financially mismanaged for years. During the period between 2013 -2016, records indicate that the Finance Department experienced high turnover with many positions filled with temporary workers or staff with little or no governmental accounting experinece.

The MOIC’s from 2013-2018 repeatedly cited evidence of accounting practices that were either missing or misinformed. The report basically stated a lack of financial controls that ultimately resulted in the city’s inability to fully close out a fiscal year and start a new fiscal year with accurate accounting. Although they repeated this as a problem, and the city made new hires in the Finance Department problems persisted.

Overall, a city agency that cannot successfully close out its books, collect reimbursements, and manage grants ultimately impacts the health of the general fund and hinders decision making on clear facts.

Interfund Borrowing

For at least the past 8 years, the other funds borrowed from the General Fund with the intention of replacing funds the next fiscal year, but never doing so. Funds were borrowed from the General Fund and the debt was listed as an asset even though the other funds had no funds to pay back the General Fund.

EVIDENCE

The 2015 MOIC reported that the General Fund and Capital Improvement Fund had borrowed $2.2 million from other funds as of fiscal year end, including borrowing from restricted funding resources such as the Integrated Waste Management Enterprise Fund and the Municipal Services Corporation Special Revenue Fund. “ (MOIC 2015 page 5) This interfund borrowing depleted the General Fund.

A review of the years 2015-2017 demonstrates that management ignored warnings and continued to make transfers that resulted in inaccurate accounting and budget information. As a result, the “so called” balance budget reported by the City staff, and passed by the Council, is by no means balanced. When funds were transferred out of the general fund it was done without action by the Council and without a plan for repayment. The auditor also reported most of those agencies did not have any identifiable ways to pay back the money.” In short, these were not loans, but a debit.

Who should we attribute or hold accountable to a continued pattern of what appears to be accounting practices that ultimately defer the inevitable situation that bring us to our situation today? The Finance Director? The City Manager? The City Council? In other words, who was reading the reports and who was holding City Management accountable to the promises made to redress these issues?

Please refer to part two here.

REFERENCES

2013 Memorandum of Inner Control

2014 Memorandum of Internal Control

2015 Memorandum of Internal Control

2016 Memorandum of Internal Control

2017 Memorandum of Internal Control

2018 Memorandum of Internal Control

One thought on “Looking backwards-El Cerrito did not get into a 5.5 million dollar hole yesterday. Part One of Two”