El Cerrito’s pension liability has grown into a major fiscal challenge—and one a local data scientist is working on to make the problem more understandable for the public and policymakers.

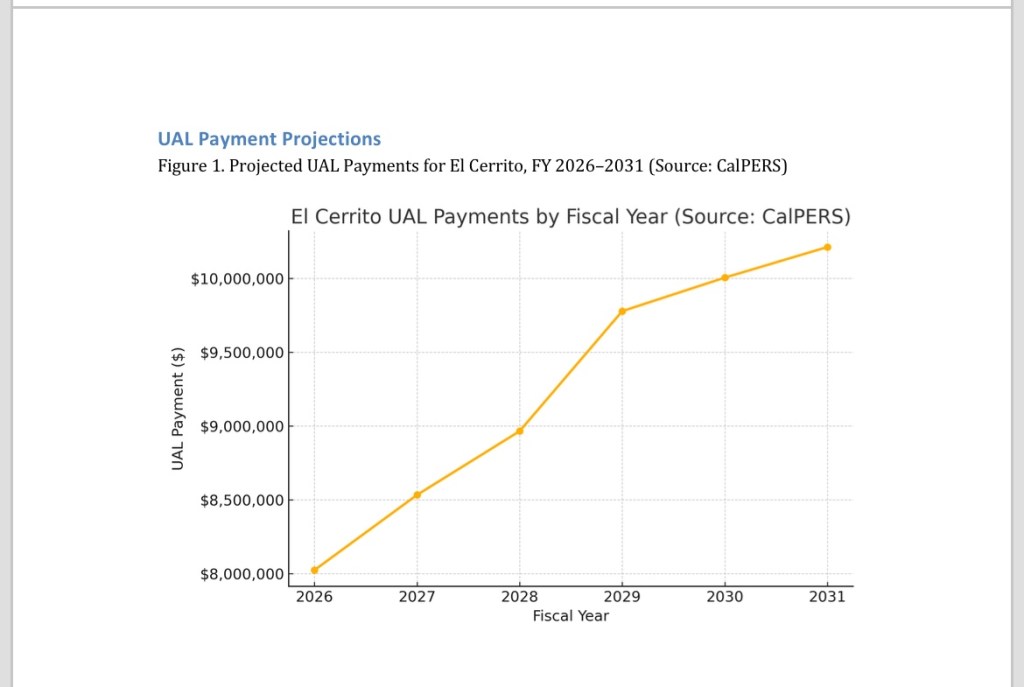

Since the California State Auditor placed El Cerrito on her high-risk cities watch list in late 2019, the city has faced heightened scrutiny over its financial practices. Now, the city projects annual deficits for the next ten years, even before accounting for basic infrastructure needs. At the center of the crisis is El Cerrito’s CalPERS Unfunded Accrued Liability (UAL), a debt that currently totals more than $89 million.

To help the community better grasp the scale and long-term implications of this obligation, Ira Sharenow, an El Cerrito-based data scientist and researcher, has produced a comprehensive analysis using state pension data. Sharenow has been analyzing city finances since the auditor’s review began, and his latest contribution brings a level of clarity and technical depth rarely seen in local government reporting.

His findings are summarized in a well-documented Word report that includes:

– A breakdown of pension liabilities by plan (e.g., Classic Safety vs. PEPRA)

– Analysis of amortization schedules through FY 2030

– Side-by-side comparisons of assumptions used by CalPERS and private pension systems

– Historical trend charts on funding status, payroll, and UAL growth

– Risk metrics including the asset volatility ratio and support ratio

To complement the written report, Sharenow also developed an interactive Excel workbook featuring dynamic pivot tables and charts that allow readers to explore the data by plan, year, and metric. For those who prefer a visual summary, he published an interactive Tableau dashboard that illustrates how El Cerrito’s pension burden grew over time.

What makes this work especially compelling is that it goes beyond surface-level numbers. It explains how overly optimistic assumptions—such as CalPERS’ 6.8% return rate—can distort fiscal projections. The report also references external research, including a Stanford researcher’s 2017 warning about pension costs crowding out local services, and includes a detailed appendix on actuarial assumptions and public pension risks.

The data are clear: without meaningful policy adjustments or a more aggressive funding strategy, El Cerrito’s pension debt will continue to limit its ability to provide basic services like public safety, recreation, and senior support.

Sharenow’s work provides residents, journalists, and decision-makers with a roadmap for understanding the problem and weighing solutions. It’s an example of how civic-minded data analysis can shine a light on public sector challenges—and perhaps help drive change.

View informative charts and the full analysis:

– Summary charts: https://irasharenow100.github.io/el-cerrito-calpers/

– Word + Excel reports on GitHub: https://github.com/IraSharenow100/el-cerrito-calpers

– Interactive dashboard on Tableau: https://public.tableau.com/app/profile/ira.sharenow1281/viz/UALProject202507/ElCerritosUnfundedAccruedLiability

with all of that, the city manager recently had the employer PERS contribution placed back into her contract tract so when she retires, will boisterous her pension by 12%. She was part of the negotiating team that forced emoyees to give this up in 2012/2013.

LikeLike

LikeLike