During the May 20, 2025 presentation to the El Cerrito City Council, NHA Advisors—serving as the city’s financial advisor—essentially blamed CalPERS for El Cerrito’s $89 million Unfunded Accrued Liability (UAL), citing underperformance in investment returns.

But that explanation doesn’t hold up to scrutiny.

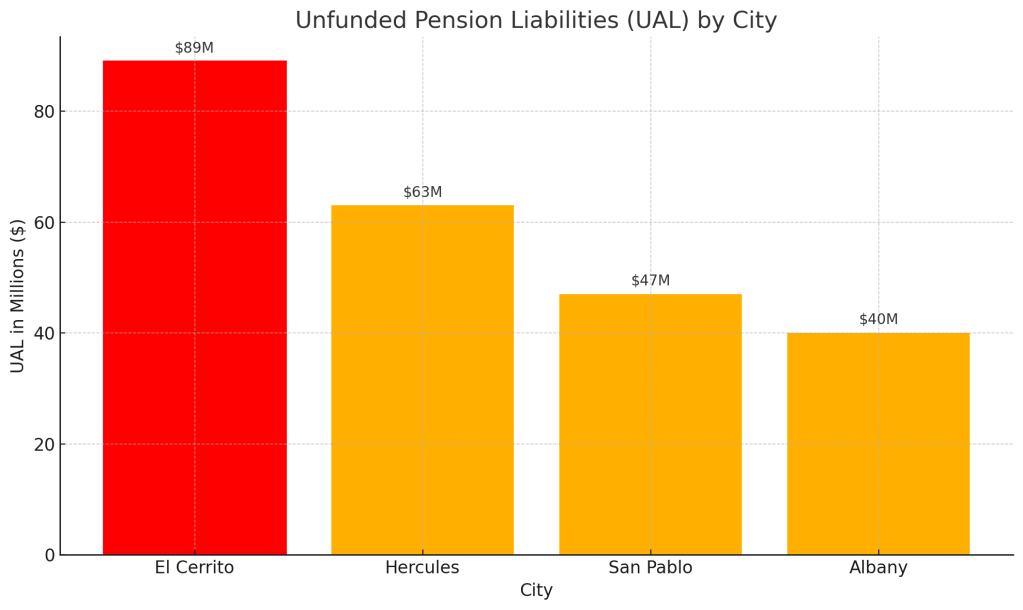

Other cities relying on CalPERS are not facing pension liabilities near this magnitude. In fact, many neighboring cities with similar populations and economic challenges are in far better shape. The real issue isn’t CalPERS—it’s El Cerrito’s staffing and financial strategy decisions.

How El Cerrito Compares

| City | Population | UAL (Approx.) | Maintains Own Fire? | Maintains Own Police? |

| El Cerrito | 25,000 | $89 million | Yes | Yes |

| Hercules | 26,000 | $63 million | No (contracts with ConFire) | Yes |

| San Pablo | 31,000 | $47 million | No | Yes |

| Albany | 20,000 | $40 million | No (contracts with ConFire) | Yes |

The data reveals a pattern: cities contracting out fire services—particularly with Contra Costa County Fire Protection District (ConFire)—have significantly lower UALs. El Cerrito, by contrast, retains both fire and police services internally, and 63% of its total UAL is tied to these two departments.

Missed Financial Opportunity

NHA also noted that El Cerrito created a Section 115 Pension Trust several years ago to set aside funds for future pension obligations. While well-intentioned, the city’s choice of a highly conservative investment strategy for this trust has sharply limited its returns.

Had the city instead sent the initial $1.4 million contribution directly to CalPERS, it would have realized roughly double the investment return over the same period. This is because CalPERS’ pooled investments, though not risk-free, generally offer more substantial long-term returns than low-risk money market or bond-focused strategies. Moreover, CalPERS charges 6.8% on the outstanding debt, so it would benefit the City to reduce the debt in the most effective way.

To make matters worse, nearly all other cities using a Section 115 Trust are in surplus positions. Because they don’t need to draw down funds immediately, they can afford to invest more aggressively—often outperforming even CalPERS. El Cerrito’s shortfall and delayed contributions prevent it from accessing these higher-yield strategies, effectively turning a valuable tool into a missed opportunity.

Conclusion: A Structural Problem, Not Just a Market One

Blaming CalPERS obscures the city’s responsibility for its financial posture. Structural choices drive El Cerrito’s pension crisis:

- Maintaining high-cost public safety departments internally

- Electing a conservative investment posture while underfunded

- Delaying meaningful pension reform or regional collaboration

Until these issues are addressed, residents will shoulder the burden—whether through higher taxes, service cuts, or financial instability. The time for honest, data-driven planning is long overdue.

Correction for Accuracy:

San Pablo also contracts with Contra Costa County Fire Protection District (Con Fire) for its fire services. However, Albany does not contract with Con Fire, as Albany is located in Alameda County.

Just for accuracy, San Pablo also contracts with Con Fire. Albany does not. Albany is in Alameda County.

LikeLike

Thank you

LikeLike

Correction made – appreciate your attention

LikeLike