El Cerrito’s budget problems are no secret—but too often, they’re discussed in the abstract. This post provides clear, verifiable evidence that over the past eight years, the City has been living beyond its means. The numbers are drawn directly from official city documents and CalPERS reports. The analysis is nonpartisan and was created to inform—not alarm—residents and policymakers alike.

Rising Pension Debt: The Classic Safety UAL

The unfunded liability (UAL) for the City’s Classic Safety pension plan has grown from 38 million dollars in 2014 to nearly 89 million dollars in 2023.

This chart, based on CalPERS actuarial valuations, shows the year-by-year rise:

These numbers matter. Every dollar spent servicing pension debt is a dollar that can’t be spent on fire protection, police, or infrastructure.

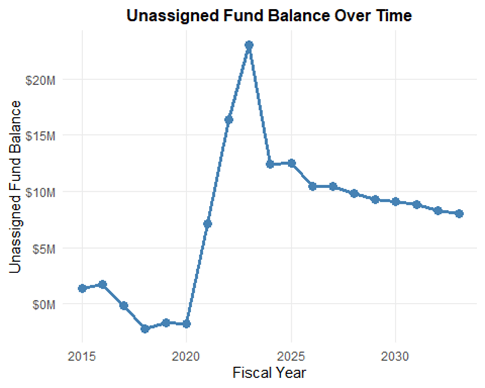

The Unassigned Fund Balance: A Warning Sign

For four consecutive years, El Cerrito’s unassigned General Fund balance was negative—a sign the City lacked even the most basic fiscal cushion.

A Broader Pattern of Unsustainable Spending

Additional analysis (available in the full report) reveals the following:

- – General Fund expenditures have grown much faster than inflation, particularly in the core Fire department.

– Revenues have not kept pace, leading to repeated operating shortfalls.

– The City’s Pavement Condition Index (PCI) has hovered at dangerously low levels.

– El Cerrito’s credit rating was downgraded multiple times over the past decade—signaling investor concern over the City’s financial management.

These trends are presented in an interactive dashboard, along with downloadable data and documentation:

🔗 View Dashboard on Tableau Public: https://public.tableau.com/app/profile/ira.sharenow

🔗 See Full GitHub Project with Code and Data: https://github.com/IraSharenow100/el-cerrito-budget-project

What Needs to Happen

The City Council and management need to:

- – Be transparent about the structural imbalance between revenue and expenses.

– Avoid new capital obligations (like a library that may cost over $100 million over the next 30 years) until pension liabilities are better controlled.

– Consider modest new revenue sources, such as a temporary parcel tax to fund pension stabilization.

– Set policies for managing one-time surpluses and long-term capital needs.

This isn’t about blame. It’s about clarity.

The longer hard decisions are delayed, the fewer options the City will have. The data is there. The time to act is now.