At the upcoming July 17 council meeting, council members are expected to propose a “forever tax” to be placed on the November ballot. If approved by the voters this tax will be imposed on the sale of tangible personal property and the storage, use, or other consumption of such property. The proposed tax rate would be one percent (1.0%) of the sales price of the property. Revenue from this tax would be collected by the California Department of Tax and Fee Administration and remitted to the City of El Cerrito. Notably, this tax would remain in effect indefinitely until ended by voters, requiring a simple majority vote for approval.

This proposed tax is designed to be a general fund tax, meaning it will need just 50 percent plus one vote to pass. In contrast, a dedicated library tax currently requires a two-thirds majority. Additionally, a state proposition on the ballot for the library forever tax aims to lower the required percentage to pass construction issues down to 55 percent.

One significant consideration is that a forever tax has never been repealed by El Cerrito voters. Once implemented, these taxes tend to remain in place indefinitely. Moreover, adding repeal measures to the ballot is both expensive and time-consuming, further complicating any future efforts to reconsider such taxes.

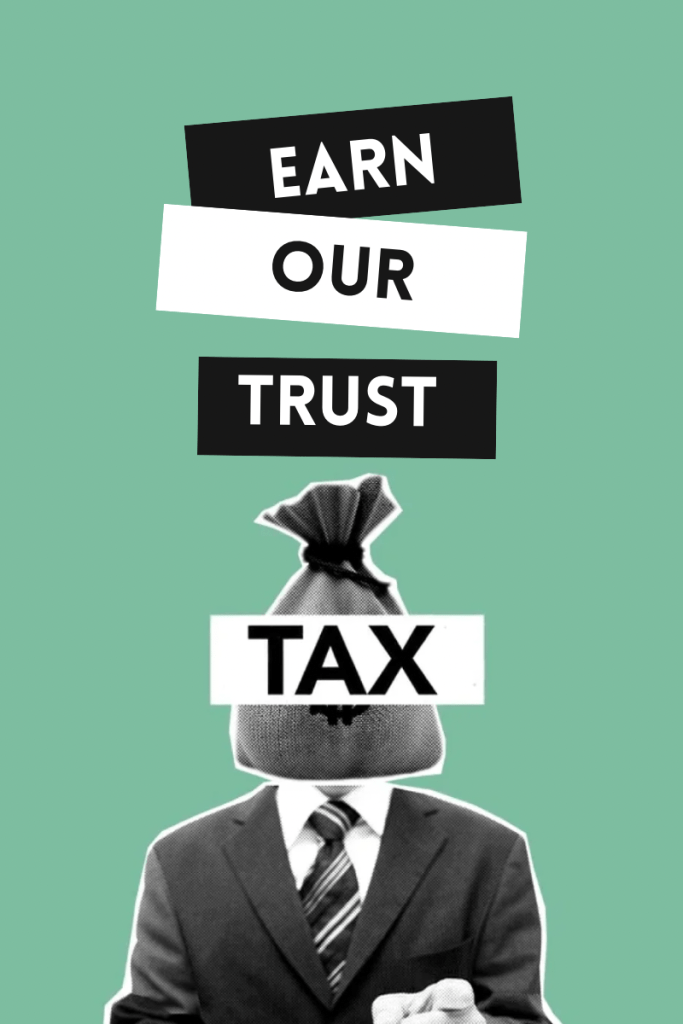

Others are concerned about the city’s push to get voters to enact new taxes that never expire. Placing an expiration date on each tax gives voters a clear opportunity to vote yes if they are satisfied with how money is being spent and no if they are not. To say that voters can repeal a tax if they don’t like it is absurd since this places a tremendous burden on citizens to figure out the process and collect a large number of signatures. That’s why it is wise to enact taxes that expire within a reasonable amount of time. If the council votes on July 17 to place a “forever” sales tax extension on the ballot, the council needs to break their silence, engage the public, and discuss their reasoning.

Voters in El Cerrito will not only decide on the forever tax but also weigh in on significant measures at the state and regional levels. One notable item is the Bay Area affordable housing bond measure, which aims to raise $20 billion for affordable housing, potentially increasing property taxes by a few hundred dollars per year. Other state bond measures will also be up for consideration, reflecting a broader effort to address housing and infrastructure needs across California.

The introduction of these measures highlights the ongoing fiscal challenges and priorities within our community and state. As we approach the November election, it will be crucial for residents to understand the implications of these taxes and bond measures on our local economy and public services.

For more details on the July 17 council meeting agenda, you can visit the El Cerrito city portal.

Stay informed, and make your voice heard at the ballot box this November.

I attended the July 17 meeting last evening and it was a pathetic and stupid display of City leadership. First of all there was no leadership present. Nobody, not one elected representative or the City Manager was in attendance at a meeting advertised as an opportunity for “the public to provide feedback on the Master Plan for the project”. After a short presentation the presenter Sean of the Community Development Office wanted to “break out” into corners stationed by staffers and address people’s questions individually. Why? The people in attendance protested and he held a short question and answer period of less than an hour. Most distressing was the refusal to answer questions about the City proposed funding for the library located in Parcel C West that is labeled in the Executive Summary as the “public library anchoring the project at the corner of Liberty and Fairmount Avenue”. A tenant designated as the “anchor” is a very important feature of this development but the City is silent on the details of what the City has already proposed! The City is asking the property tax payers to contribute $20,000,000 and substitute their property tax payment and real property (their home) as the only repayment source and collateral under a General Obligation Bond funded by a Supplemental Tax. That’s asking the property tax payers to effectively donate $20,000,000 (GO Bond) to the developer to fund construction of a building that may cost $50,000,000 but nobody will say what the construction cost will be for Parcel C West. What a subsidy! $20,000,000 the developer pays NO INTEREST or PRINCIPLE and will gain a fee interest on an unencumbered property which can be leveraged easily. What a deal for the developer (and the City who will have to have some type of fee interest). The City is “captured” by the developer with their interests aligned leaving the taxpayers in the cold.

On Sat, Jul 13, 2024 at 7:54 AM El Cerrito Committee for Responsib

LikeLike

Apparently, the library project is window dressing for the real purpose. The city needs the revenue.

LikeLike