Next Tuesday’s city council meeting has been canceled with no explanation provided.

Last week’s budget workshop was not recorded on video, and during this session, the community raised several probing questions about the city’s finances. The City Manager had to revise earlier statements about salary freezes, clarifying that these were temporary measures affecting mainly non-represented staff. This clarification is important as nearly all staff are union-represented, meaning the impact of these freezes was less substantial than initially implied by the City Manager.

Furthermore, despite City Manager claims of collaboration with the Financial Advisory Board, significant topics such as Library forecasts, costs associated with promoting the library tax measure, the renewal of Measure R, the growing pension unfunded liabilities, and the expenses related to implementing the classification and compensation study have not appeared on the agenda which means these topics have not been presented in FAB meetings.

The debate over the relocation of El Cerrito’s library involves significant community concern regarding the proposed move from Stockton Avenue to the Plaza BART Transit Oriented Development. The city has presented a single option: a $54 million library project funded by a “forever tax” of $300 per homeowner. An editorial highlight that the city’s focus on the Plaza site, which would involve leasing rather than owning the property, lacks transparency and fails to consider community preferences. The current Stockton Avenue location offers great accessibility and is well-integrated with the community, contrasting with the proposed site’s potential for increased congestion and higher operating costs. The editorial calls for more open dialogue on potential sites, empowering residents to have a meaningful say in the library’s future.

Concerned citizens have questioned the financial rationale behind spending $200,000 to promote the tax measure when more cost-effective options might exist.

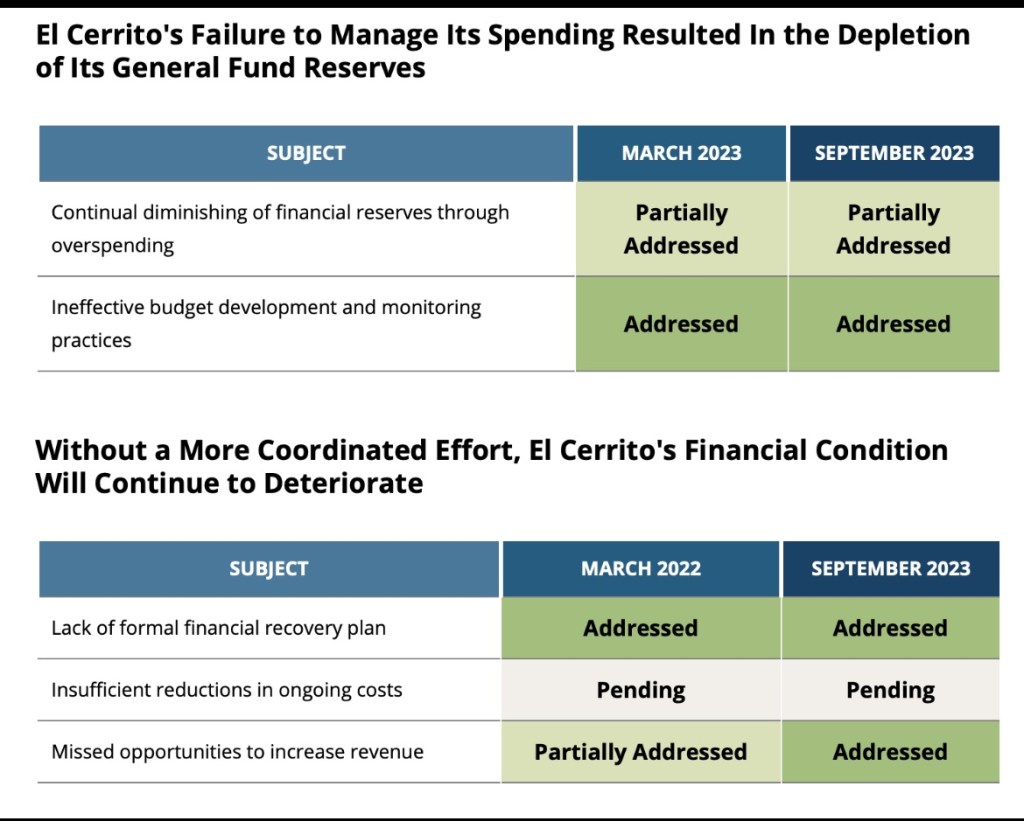

Another citizen invited fellow El Cerrito residents to the budget workshop which seemed to draw a crowd at the budget workshop. Despite the City Manager asserting that all the state auditor’s recommendations have been implemented, she struggled to substantiate this claim.

Several issues discussed during the workshop were not satisfactorily addressed by the city:

El Cerrito’s Fiscal Challenges: Managing Pension Costs and Navigating a Narrow Budget Surplus

The state auditor said that the city has recently taken measures to manage its pension costs by allocating $1 million to initiate a Section 115 trust in August 2023, and subsequently approving the creation of the trust in September. However, it has yet to establish an ongoing funding strategy for this trust, which is crucial for maximizing its long-term benefits. Furthermore, the trust is set at just $1 million which is about 1.1% of the unfunded pension liability of $85 million leaving $84 million unfounded.

El Cerrito’s fiscal situation remains precarious with the FY 2023-24 budget showing only a slight surplus of $93,000. This is partly due to reliance on robust real estate transfer taxes, which may not be sustainable as the real estate market shows signs of slowing, although tax consultants predict steady real property tax revenues. The city anticipates it will need to vigilantly monitor and potentially adjust its budget to prevent expenditures from surpassing revenues.

Moreover, upcoming labor agreements pose additional financial challenges. The city has agreements ending soon with various employee groups, and previous agreements have included significant salary raises. Similar future increases could push expenditures beyond current revenue levels, exacerbating fiscal strains.

Without a More Coordinated Effort, El Cerrito’s Financial Condition Will Continue to Deteriorate: Insufficient Reductions in Ongoing Costs

The state auditor elaborated further: El Cerrito has shown improvement in its financial condition but continues to face challenges with the growth of salary and benefit costs, which constitute a major portion of its expenditures. To address these concerns and recommendations for cost reduction, the city issued a request for proposals for a comprehensive classification and compensation study. This study, which was expected to be completed in December 2023 after a delay, is intended to help the city adjust salaries appropriately and use the insights gained to sustain financial stability. It will provide a detailed review of El Cerrito’s organizational structure, compensation practices, and staffing needs, enabling the city to make strategic decisions about the number and type of positions it can support, as well as the scope of services it can realistically offer.

It’s crucial to point out that El Cerrito proceeded with and completed a classification and compensation study in 2024 without first evaluating its staffing levels. Consequently, the city is unsure if it has the right number of staff to efficiently provide services. Specifically, El Cerrito may have an excessive number of certain positions, such as Battalion Chiefs, where it is unusual for a city of its size—comparable more to a town—to have four Battalion Chiefs.

These hot topics including the public outcry regarding the Israel- Hamas ceasefire is looming.

The Budget Workshop was not available remotely or recorded on video. Additionally, there are no plans to make Financial Advisory Board meetings available remotely or to record them, suggesting that the City Manager and Council are likely opposed to hosting follow-up sessions on a video-recorded platform increasing concerns about transparency.

Here’s how you can help:

- Attend the Financial Advisory Board meeting at City Hall on April 23rd.

- Ask the City Council to require that the meeting be available remotely to the public and videotaped.

Share your voice with the Council Members, the Mayor, and the City Manager.

- Karen Pinkos-City Manager kpinkos@ci.el-cerrito.ca.us

- Councilperson Gabe Quinto gquinto@ci.el-cerrito.ca.us

- Councilperson Carolyn Wysinger cywysinger@ci.el-cerrito.ca.us

- Councilperson Tessa Rudnick trudnick@ci.el-cerrito.ca.us

- Mayor Lisa Motoyama lmotoyama@ci.el-cerrito.ca.us

- Councilperson Paul Fadelli pfadelli@ci.el-cerrito.ca.us

replacing the library at the Stockton site WILL NOT HAVE AN IMPACT on the City budget B/C a construction bond is financed by property owners who pay the debt service just like the schools and the pool. The City only needs to maintain the building and pay the utilities (just like it would at the proposed BART TOD site). The library at BART is a SPECULATIVE real estate venture by the City to use the library to 1. subsidize the cost of constructing a 6 story housing development to create a “destination location’ or a “Barnes & Noble” for their “downtown” development which is a shopping center. The City knows that for the housing developer to find retail tenants for the 20k of ground floor space is highly unlikely and would damage the financing prospects if needed to replace the 20k space with non credit tenants (a supplemental property tax is gold star credit risk for the underwriters). So lets be practical and get on with building a new library building that everyone agrees is needed and is the highest and best use of the land the City owns and the quickest way to get the library built and operating. Oh the CCC Library commission has yet to weigh in on the 2024-2025 library budget and how much they will be allocating for EC new library operation.

LikeLiked by 1 person