El Cerrito, recognized for its dynamic community, strategic location, and picturesque settings. The City Manager Karen Pinkos maintains that the city’s financial health is strong, but a closer examination suggests a more complicated financial reality.

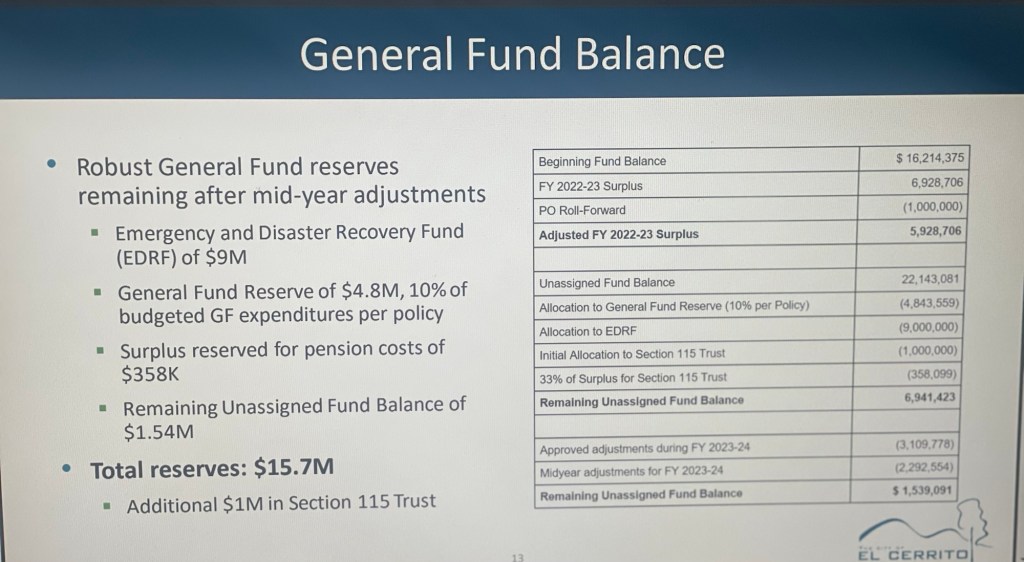

Detailed Financial Assessment The city’s reported $15.7 million in total reserves masks underlying issues, particularly the distinction between restricted and unrestricted funds.

While the city began the fiscal year with $22.14 million in unrestricted reserves, it allocated $9 million to emergency reserves and $1.4 million to the Section 115 Trust, aimed at pre-funding pension and other post-employment benefits. An additional $4.8 million was earmarked for the general fund reserve. However, after covering $5.4 million in overspending for FY24, only $6.4 million remains available as unrestricted reserves, which is below the Government Finance Officers Association’s (GFOA) minimum recommendation of $8 million, or two months of operating expenses.

Fiscal Mismanagement and Overspending This situation is particularly concerning given El Cerrito’s pattern of annual overspending. The city has dipped into $5.4 million to manage expenditures exceeding budgeted amounts in FY24 alone. This ongoing fiscal behavior does not align with sustainable financial practices and puts the city at risk, especially without the prospect of additional federal aid.

Staffing and Operational Costs The city’s organizational structure, which includes an Assistant City Manager and four battalion chiefs for a population of 25,000, suggests potential overstaffing. An in-depth analysis of staff size and composition, which has been avoided, could reveal inefficiencies and opportunities for cost reduction.

Anticipated Challenges with Labor Costs El Cerrito’s financial outlook is further complicated by upcoming renewals of labor agreements. The city has already finalized agreements with firefighters that include salary increases above the budgeted projections. If similar raises are granted to other city employees, El Cerrito may face a situation where its salary expenditures significantly exceed its revenue growth, exacerbating the financial strain.

Takeaway: The City Manager needs to understand the long term impact of compounded salary increases on the long term stability and pension costs.

State Auditor’s Findings The city has not adequately addressed recommendations from the State Auditor, particularly concerning the reduction of ongoing expenses and management of pension liabilities. The State Auditor’s findings regarding El Cerrito’s financial management provide crucial insights into the systemic issues affecting the city’s fiscal health. These findings highlight several areas of concern, particularly in terms of pension liability management, revenue projections, and the city’s overall financial sustainability. Here’s a detailed exploration of these findings:

Pension Liability Management One of the most critical issues identified by the State Auditor was El Cerrito’s handling of its pension liabilities. The city has a significant pension liability of $85 million but has set aside only $1 million, which is just about 1.2% of the total debt owed to the California Public Employees’ Retirement System (CalPERS). This underfunding poses a long-term risk to the city’s financial stability. The State Auditor rated El Cerrito 0 out of 10 for its approach to managing this liability, indicating a severe lack of preparation in addressing future pension obligations.

Revenue Management and Projections The State Auditor also pointed out problems with how El Cerrito manages and projects its revenues. The city’s overall revenue was $1 million more than budgeted for the year, but this figure was $2.5 million less than the revenue reported in the prior year. This volatility in revenue projections and actual collections suggests weaknesses in the city’s financial planning and analysis capabilities. Earlier in the year, the city had also reduced its Real Property Tax projections by $1 million based on an overly optimistic assessment, further complicating its revenue estimation accuracy.

Financial Sustainability Ratings Further compounding these issues, the State Auditor gave El Cerrito a low rating of 2.7 out of 5 for Revenue Trends. This rating reflects not only the city’s fluctuating revenue streams but also its reliance on factors that may not be sustainable in the long term, such as the most recent need to reduce the revenue budget by $1 million. Such dependence on variable revenue sources without a stable backup plan undermines the city’s ability to maintain financial health, especially in economic downturns.

Compliance with Recommendations Despite claims from the city management that all State Auditor recommendations have been met, the ongoing financial practices suggest otherwise. The State Auditor’s recommendation to decrease ongoing expenses has not been sufficiently addressed, as evidenced by the city’s continued dependency on the general fund to cover over-expenditures. This indicates a pattern of fiscal mismanagement that fails to align with prudent financial practices.

State Auditor’s findings underscore a need for significant reform in El Cerrito’s financial management practices. Addressing these issues is crucial for ensuring long-term fiscal sustainability and regaining public trust in the city’s financial governance.

Tax Proposals and Public Confidence The proposal for a new $300 tax to fund a library project raises questions about fiscal responsibility and transparency, given the city’s history of diverting earmarked funds to cover general expenditures. This pattern undermines public trust and casts doubt on the city’s commitment to delivering on its promises.

In summary, while El Cerrito’s City Manager claims a strong financial standing, the details of the city’s financial management reveal a troubling scenario of insufficient reserves, chronic overspending, and inadequate planning for future liabilities, all of which challenge the sustainability of its fiscal policies.

Here is how you can help:

- Share this post with other residents.

- Comment on the post

- Attend the monthly Financial Advisory Board meetings in person.

- Post on Next Door

- Voice your concerns with the Council.

Council meetings are remote and in-person, but public comment is now limited to in-person attendees.

- If you want to contact City Council Members or the City Managers, all their emails are below:

- Karen Pinkos-City Manager kpinkos@ci.el-cerrito.ca.us

- Councilperson Gabe Quinto gquinto@ci.el-cerrito.ca.us

- Councilperson Carolyn Wysinger cywysinger@ci.el-cerrito.ca.us

El Cerrito is in trouble, reduce ovehead, I am not a financial person, but looks like we are broke or close to broke. Please apply for bonds, must be ways other cities are qualifing for help. How about a committee, for reducing overhead? The library in Bart is a joke-we can’t afford millions in debt-don’t understand how we wouldn’t own the property and need to pay rent. EC Library is debt free, stop spending money to shut it down, well-run, and if we have zero money-0-no more library at Bart. Quit wasting money, spend extra money on paying our debts, pensions and becoming financial solvent.

LikeLiked by 1 person