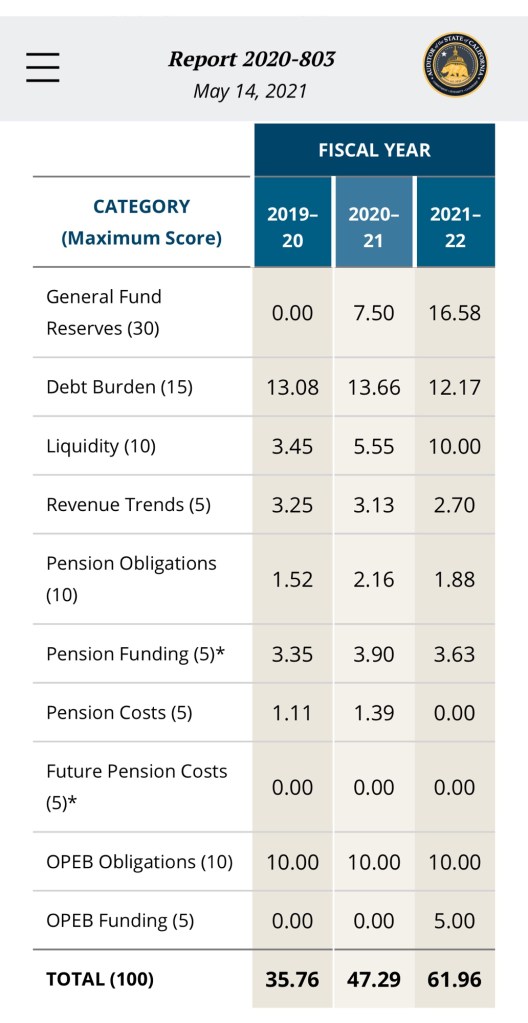

Nearly 4 years ago in March 2021, the California State Auditor released a report exposing severe financial challenges in the City of El Cerrito. At that time, state auditor ranked El Cerrito, the sixth most likely city in the state of California to become bankrupt

These issues included the depletion of unrestricted reserves, a structural imbalance between revenues and expenses, a significant unfunded pension liability, and payroll costs that far exceed those of comparable cities.

Despite the gravity of these findings, and the city now ranks 13th mostly likely to go bankrupt, El Cerrito continues to act as though it is in a strong financial position, failing to disclose its unrestricted fund balance or demonstrate significant progress in implementing the auditor’s recommendations. This lack of transparency underscores the urgent need for a shift in leadership priorities and fiscal management.

Ongoing Financial Mismanagement

The auditor’s report revealed that El Cerrito had entirely depleted its unrestricted reserves by fiscal year 2016–17, leaving the city with no financial safety net. Since then, there has been no clear disclosure of the current reserve balance, raising doubts about claims of financial stability. Without tangible evidence of improvement, these assurances ring hollow.

Adding to the concern, the city continues to spend beyond its means, perpetuating a structural imbalance between revenue and expenses. Relying on mid-year budget revisions to adjust spending is not a sustainable solution. El Cerrito needs to align its expenses with its revenues through proactive and disciplined financial planning.

Meanwhile, the city faces a staggering $89 million unfunded pension liability, with only $1.3 million set aside to address it. This shortfall poses a significant long-term risk, yet the city has failed to present a viable plan to reduce this burden.

Refusal to Act on Key Recommendations

El Cerrito’s payroll expenses remain significantly higher than those of similar-sized cities, a sign of inefficiency and bloated costs. Despite this, the city has refused to implement a staffing study recommended by the state auditor, which could help identify cost-saving opportunities and improve efficiency.

The auditor also provided clear directives for financial recovery, including:

• Developing a healthy unrestricted reserve balance.

• Aligning expenses with revenues (excluding items until mid-year revisions is not a remedy).

• Addressing the unfunded pension liability.

• Conducting a staffing study to evaluate payroll efficiency.

To date, the city has failed to fully implement these recommendations, further exacerbating its financial vulnerabilities.

A Facade of Fiscal Health

Perhaps most troubling is the city’s behavior, acting as though it has a strong financial position while refusing to disclose critical information like the unrestricted fund balance. This lack of transparency misleads residents and stakeholders and undermines trust in the city’s governance. Without accountability, the façade of fiscal health continues to mask deeper systemic issues.

Hope for Change

The election offers a vital opportunity for El Cerrito to chart a new course. With two new city council members, there is hope that financial health will take precedence and that decisive actions will be taken to rebuild reserves, address unfunded liabilities, and align expenses with revenues. Leadership committed to transparency and fiscal responsibility is essential to securing the city’s future.

El Cerrito’s financial challenges are not just numbers—they represent a governance crisis that impacts every resident. The city’s failure to build a healthy unrestricted reserve balance, align expenses with revenues, and address its unfunded liabilities reflects a pattern of neglect that cannot continue. Residents must demand accountability, transparency, and leadership that prioritizes fiscal sustainability. By taking these steps, El Cerrito can move beyond its financial struggles and ensure a stable, thriving future for its community.

#ElCerrito #FinancialTransparency #FiscalResponsibility #CityBudget #AccountabilityMatters #CaliforniaStateAuditor #PublicFunds #LeadershipMatters

Hi Did measure G fail, I hope? Glad to hear the two new council members might work on balancing the budget. All agencies have challenges with underfunded pension liabilities. Pamela Mirabella Former CCC Board of Education member for 28 years.

On Tue, Nov 26, 2024 at 12:00 PM El Cerrito Committee for Responsib

LikeLike

Measure G passed by 80% – likely because the city manager uses scare tactics (which are unfounded) and because they called it a 1 cent tax instead of a 1 % tax

LikeLike

and no sunset date on measure G!

Pamea Mirabella

Mirabella.pam@gmail.com

LikeLike