As budget season continues, residents of El Cerrito are once again bracing for the all-too-familiar warning: “The sky is falling.” For the fifth year in a row, the city manager has refused to conduct the staffing analysis recommended by the state auditor.

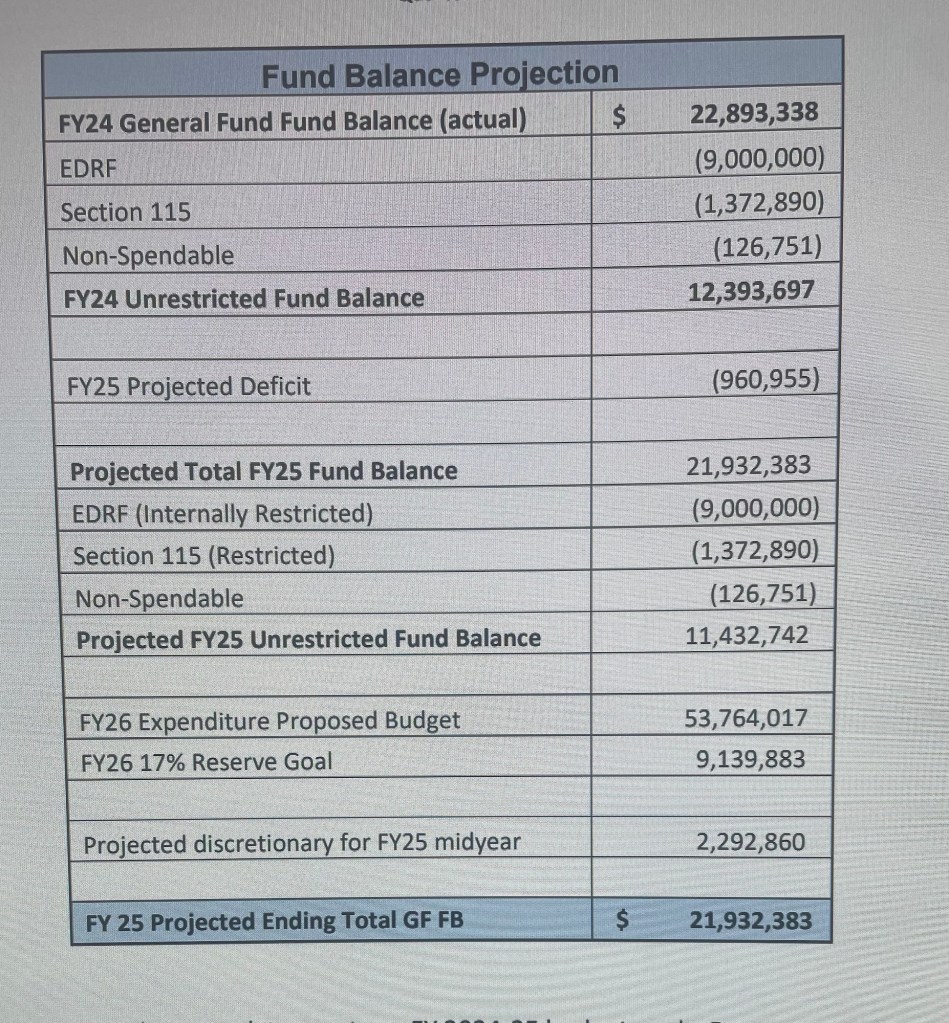

This analysis is necessary because of the continued trend of having expenitures outpace revenue. The city attempts to mask the impact of this disparity which contributes to ongoing deficit spending by continuing to compare year-end expenses to the midyear budget amount rather than comparing year-end expenses to last year‘s expenses.

Comparing year-over-year revenue and expenses tells the real story.

Instead of taking meaningful and proactive action to address the city’s financial challenges, the city manager consistently chooses to wait until the eleventh hour to use scare tactics, pushing residents to accept unsustainable solutions like tax increases.

Avoiding Accountability

The city manager’s continued refusal to conduct a staffing analysis is not just negligence—it is complete defiance of the state auditor’s recommendation. This irresponsibility has cost the city far more than her salary. By avoiding the analysis, the city manager ensures that inefficiencies and waste persist, leaving residents to foot the bill.

Every year, the city manager claims “the sky will fall” if her budget is not accepted as presented. Yet, when pressed, she cannot identify meaningful cuts or sustainable solutions. Instead, the city relies on dipping into unrestricted reserves, depleting funds that should be preserved for emergencies. At this rate, those reserves will be exhausted, leaving El Cerrito vulnerable to financial collapse.

Expenses continue outpacing revenue forcing the city to rely on increase taxes

Enough is enough. If the city manager continues to come back with scare tactics and no real solutions, the city council must act decisively. Terminating her employment would cost less than the savings generated by hiring a responsible city manager willing to tackle inefficiencies, conduct the necessary staffing analysis, and implement sustainable financial practices. Leadership that clings to the status quo is costing the city far more than it can afford.

El Cerrito residents must demand better. Enough with the excuses. Enough with the delays. Enough with the threats. This year, we must insist on the following:

Conduct the Staffing Analysis: The city manager’s refusal to act is costing us time and money through increased taxes. A staffing analysis is a critical tool to identify inefficiencies and build a sustainable budget. The city manager should:

Create a Transparent Budget: Residents deserve a budget based on facts, not fear. Leadership must prioritize financial stability and present clear, honest options to the community.

Hold Leadership Accountable: If the city manager cannot meet these basic responsibilities, the city council must act. Failing to address the root issues is a failure of leadership.

El Cerrito’s Future

The stakes couldn’t be higher. El Cerrito is not merely at a turning point—it’s sliding toward another financial crisis. Each year of inaction brings us closer to a breaking point. The only way to stop this slide is for residents to stand together and demand change.

Take Action Now

Residents, the power to change the future lies with you. Write to the city council today at the city clerk’s email address: cityclerk@ci.el-cerrito.ca.us.

Tell them you’ve had enough of scare tactics and excuses. Demand that they take real action to address the city’s financial problems.

El Cerrito deserves leadership that works for its residents, not against them. Let’s make it clear: enough is enough. The time for action is now. If necessary adopt an unbalanced budget and get the city manager to come back the next quarter with a more reasonable budget.

#ElCerrito #FiscalResponsibility #CityBudget #AccountabilityNow #LeadershipMatters #StopScareTactics #TransparentBudget #SustainableFuture #ResidentsFirst #EnoughIsEnough