The El Cerrito City Council and city boosters often tout the hard work of the city manager. But she isn’t paid to spin endlessly on a hamster wheel. Her role demands results—and El Cerrito deserves better outcomes. Unfortunately, these troubling patterns have persisted under her leadership.

Reduced Services

- Senior Center: Permanently closed, leaving seniors without a vital community hub.

- Passport Services: Permanently closed, reducing convenient services for residents.

- Children’s Water Slide: Removed, diminishing recreational options for families.

- Recycling Center: Faced significant setbacks, impacting a key sustainability resource.

- Ohlone Greenway: Riddled with potholes, prone to flooding, and frequented by speeders—with no clear plans for improvement.

- Pavement Condition: Significant decline in the city’s Pavement Condition Index (PCI).

- Pandemic-Era Service Cuts: El Cerrito reduced services and operating hours during COVID and never fully restored them.

Transparency Issues

- Survey Data Concealed: The public and even the council were denied access to critical survey data.

- Limited Library Discussions: Plans for a new library were kept largely out of the public eye.

- Transit-Oriented Development (TOD): Minimal public engagement regarding significant development plans.

- Richmond Street Project: Discussions were notably scarce. Surveys involving city streets were not conducted in a way to clearly understand parking

- San Pablo Avenue Church: The purchase of $1.6 million is unexplained. Limited information on the city’s use of this property.

- Non-Responsive Senior Managers: Key city staff routinely ignore resident emails. Little ethnic diversity among city leadership.

- Library Project Concessions: Critical details were poorly disclosed, like reducing parking from 63 to zero spaces and shrinking the $21 million unexplained costs.

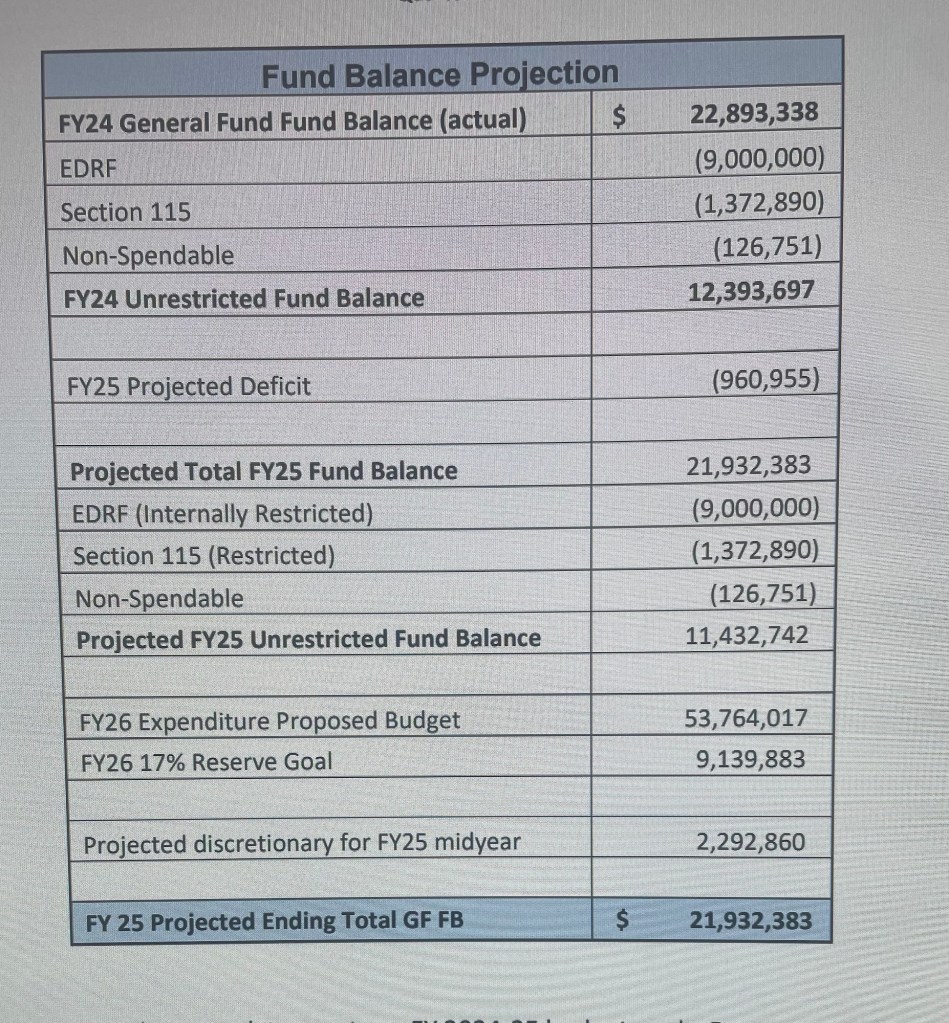

Financial Mismanagement

- Ongoing Fiscal Concerns: The city repeatedly received “going concern” warnings.

- State Audit: El Cerrito underwent a state financial audit due to fiscal mismanagement.

- Credit Downgrade: Credit ratings plummeted from A- to BBB- and only slightly improved.

- Rising Pension Liabilities: CalPERS UAL payments are nearing $8 million annually.

- Missed Opportunities: The city failed to issue pension obligation bonds during a period of record-low interest rates.

- Library Bond Inaction: The city neglected to issue library bonds when rates were advantageous.

- Library Grant Neglect: Officials didn’t even apply for $10 million in available state library grants.

- Infrastructure Crisis: The city needs $250 million in capital improvements but has no strategic plan for prioritizing projects. The state auditor warned this process will take “a very long time” at the current pace.

- High Crime Rate and Police Staffing Issues

El Cerrito has experienced a concerning rise in crime rates over the past several years. Data shows that El Cerrito has approximately 1.2 officers per 1,000 residents.

A Legacy of Overspending

The previous city manager drained El Cerrito’s reserves. The current city manager continued the pattern by significantly overspending in 2019 and again in 2024. Rather than reassess its approach, the city appears to rely on outdated templates and ignores the need for operational reform. Neither the City Council, the Financial Advisory Board (FAB), nor public forums have engaged in substantive discussions about a sustainable path forward.

COVID Windfalls Squandered

City officials claim they worked hard during the pandemic to implement improvements—but haven’t detailed what those improvements were. Meanwhile, the city benefited from unprecedented windfalls:

- ARPA Funds: $6.1 million meant to aid pandemic-impacted individuals and businesses was redirected.

- Real Property Transfer Tax: Revenues from this new tax far exceeded projections but the city can’t live within their means.

- Property Tax Surge: Low interest rates spurred housing sales, driving up property tax receipts.

- Sales Tax Reform: Legal changes to Charter city led to increased sales tax revenue.

Despite these revenue boosts, El Cerrito resumed its overspending habits as soon as pandemic-related concerns subsided.

City Manager’s Plan for Reserve Spending

The city manager has proposed using 27% of the city’s unrestricted reserves to cover ongoing deficit spending. This move raises concerns about the city’s long-term financial stability and its ability to respond to emergencies.

El Cerrito Deserves Better

Hard work alone isn’t enough. El Cerrito needs a city manager who delivers tangible results, prioritizes fiscal responsibility, restores vital services, and communicates honestly with residents. Until then, our city will continue spinning on the hamster wheel of dysfunction, moving but never progressing. Residents deserve leadership that steers toward a sustainable, transparent, and prosperous future.

Hashtags and Contact Information

#ElCerrito #CityCouncil #TransparencyMatters #FiscalResponsibility #CommunityServices #PublicAccountability

Contact the El Cerrito City Council (2025)

- Mayor Carolyn Wysinger: cwysinger@ci.el-cerrito.ca.us

- Mayor Pro Tem Gabe Quinto: gquinto@ci.el-cerrito.ca.us

- Councilmember Lisa Motoyama: lmotoyama@ci.el-cerrito.ca.us

- Councilmember Rebecca Saltzman: rsaltzman@ci.el-cerrito.ca.us

- Councilmember William Ktsanes: wktsanes@ci.el-cerrito.ca.us