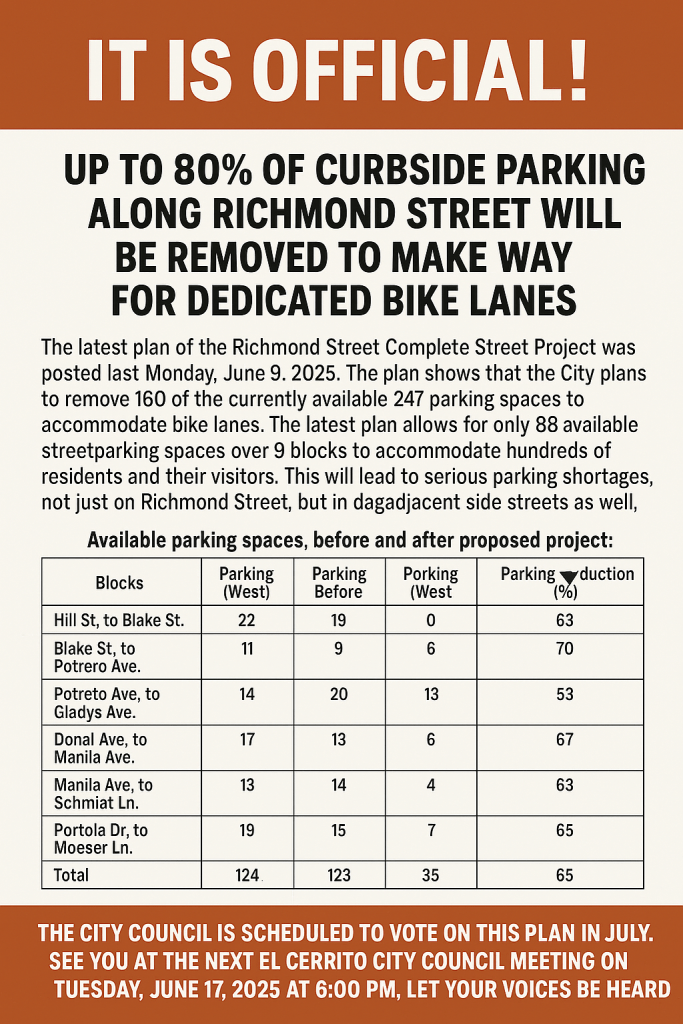

El Cerrito’s City Manager would like you to believe that the Richmond Street Complete Streets project is a model of transparency and community engagement. In her June newsletter, she thanks residents for attending the June 26 Open House, touting it as a meaningful opportunity for public input. She references nearly a year of outreach, surveys, and community events, and encourages residents to review the plans and submit comments by July 9.

But let’s be honest: the train has already left the station.

The claim that public input will shape the project’s outcome doesn’t hold up under scrutiny. The truth is, key decisions—especially the inclusion of bike lanes—were made long before last week’s meeting. The presentation on June 26 wasn’t a forum for co-creating a solution. It was a rollout.

The format made that clear. Residents were asked to submit questions on index cards. Most went unanswered. When City staff finally addressed concerns, it became evident that critical elements of the plan, like the controversial bike lanes, had already been decided.

This isn’t transparency. It’s performative engagement. It gives the appearance of listening without any real intention to change course based on what residents say.

Yes, the City held community events. Yes, they posted online surveys. But real transparency means more than checking the boxes. It means incorporating input before final decisions are made, not inviting comment after the design is effectively locked in.

The newsletter also stresses alignment with various City-adopted plans. But here’s the thing: none of those policies mandate bike lanes on Richmond Street. They offer flexibility and require thoughtful consideration of actual community needs—not just policy compliance.

So when the City Manager says, “The preliminary plans were developed following nearly a year of community outreach…”—what she’s really saying is that the City informed residents of what they’d already decided to do.

If that feels like a betrayal of public trust, it should.

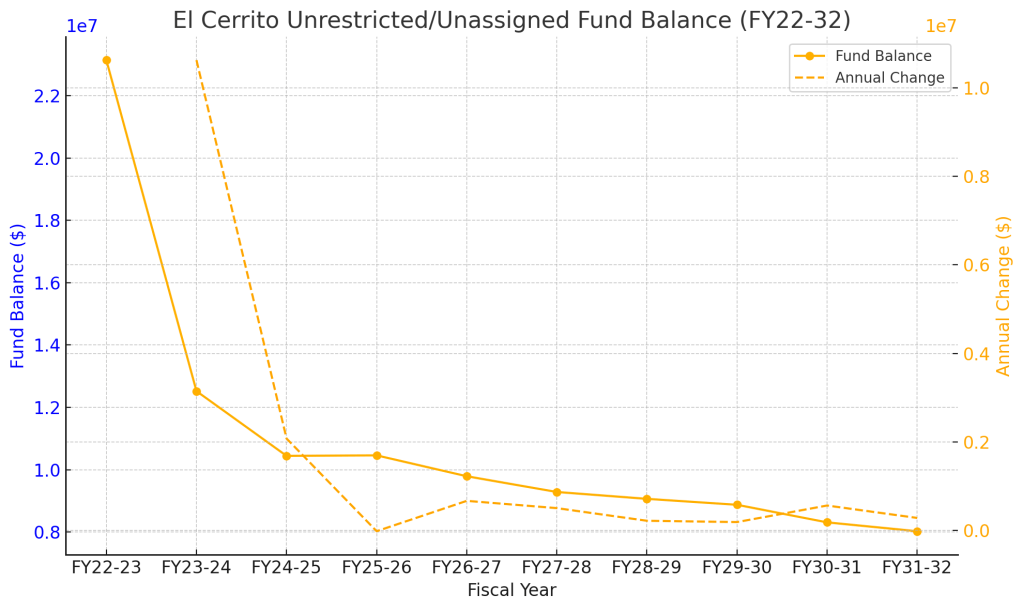

The final design will be approved by the City Engineer later this month, and the Council will discuss the broader transportation policies guiding these projects on July 15. If you’re concerned about the future of our streets being decided without authentic public input, show up. Speak up.

And if you’re tired of being ignored, it’s time to act.

We need new leadership—on the City Council and in the City Manager’s office. Leaders who believe in transparency, respect public input, and understand that residents aren’t a box to check off. They’re the reason local government exists in the first place.

If you’ve ever thought, “This city could be better run”—now is the time to step up. El Cerrito needs leaders who will listen, question, and prioritize the public interest over pre-packaged plans. The next City Council election is in November 2026, and it’s not too early to start building a campaign rooted in transparency, accountability, and real community engagement. We need two strong candidates who are ready to challenge the status quo and stand up for residents. If that sounds like you—or someone you know—it’s time to get organized. Let’s not settle for being explained to. Let’s elect people who will lead with integrity.