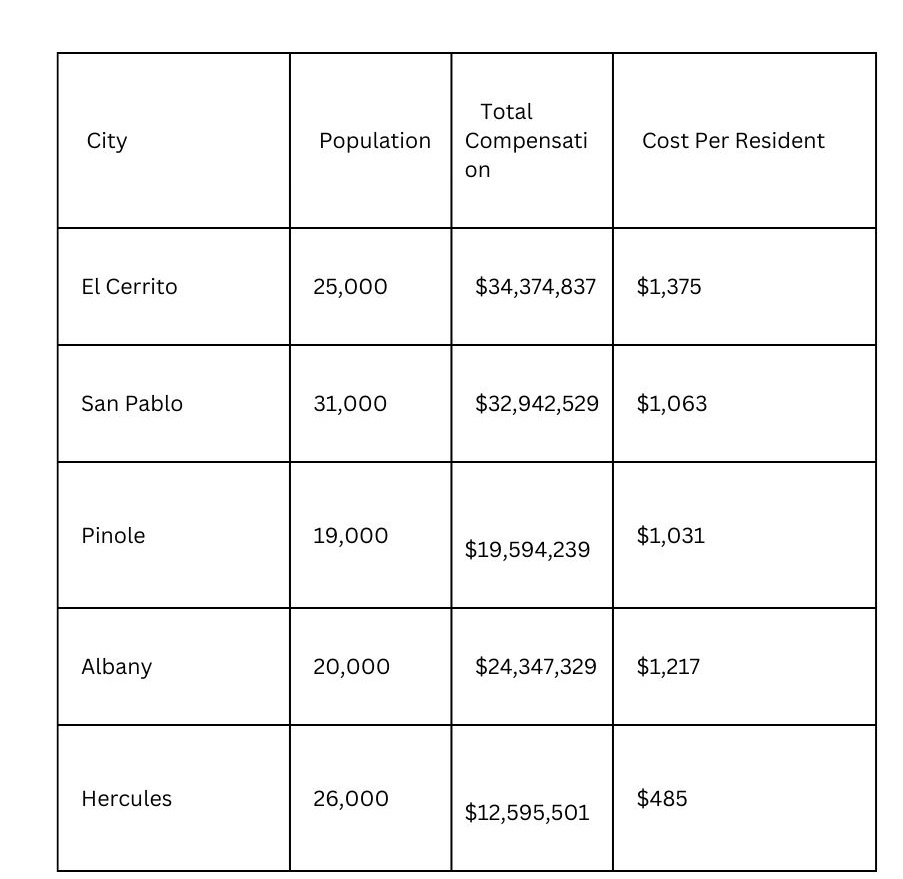

The El Cerrito Police Department’s recent presentation on planned technology deployments has raised critical concerns about the city’s law enforcement priorities and fiscal responsibility. Proposals for tools such as Automated License Plate Readers (ALPR) for parking enforcement, facial recognition systems for criminal investigations, and both indoor and outdoor drones signal a shift toward expensive, high-tech solutions. However, moving forward with such investments—particularly facial recognition software and drones—would be both irresponsible and misaligned with the city’s financial constraints and actual public safety needs.

Facial Recognition Software: High Costs, Low Value

Facial recognition technology is a controversial and costly tool that has no place in a small city like El Cerrito. Chief of Police Paul Keith emphasized in his presentation that larger agencies are willing to provide mutual aid at no cost, yet the city is still considering this significant expenditure. The downsides are glaring:

- Fiscal Irresponsibility: Implementing facial recognition software would further strain El Cerrito’s limited budget, diverting funds from crucial services like infrastructure or community programs.

- Privacy and Ethical Concerns: Facial recognition raises significant civil liberty issues, including the risk of surveillance overreach and racial bias in its algorithms.

- Misalignment with Priorities: This technology is reactive, addressing crimes after they occur, rather than preventing them—a missed opportunity to embrace proactive policing strategies.

El Cerrito doesn’t need facial recognition software. With mutual aid agreements already in place, the cost outweighs any perceived benefit.

Drone Deployment: A Costly and Questionable Move

In addition to facial recognition software, the department has proposed deploying indoor and outdoor drones. While drones can offer utility in specific scenarios, the justification for their use in a small city like El Cerrito is weak. These high-tech tools come with hefty price tags for equipment, training, and maintenance, raising concerns about:

- Limited Applicability: Drones are typically used by larger agencies with vast jurisdictions or unique operational needs. Their value in El Cerrito’s context is unclear.

- Community Trust: The introduction of drones could heighten resident concerns about privacy and government surveillance, further eroding public trust.

- Ongoing Costs: Beyond the initial purchase, maintaining a drone program requires ongoing expenses for staff training, certifications, and software updates.

The city must carefully consider whether the marginal benefits of drone deployment justify the significant financial and social costs.

A Smarter, Proactive Approach to Public Safety

Rather than investing in expensive, reactive technologies, the El Cerrito Police Department should refocus its resources on preventative and community-based solutions. Strategies aligned with 21st Century Policing can deliver sustainable safety improvements without breaking the budget:

- Community Policing Initiatives: Building stronger relationships between officers and residents fosters trust and reduces crime through collaboration.

- Youth Programs: Engaging young people through outreach and mentorship can prevent criminal activity before it begins.

- Mental Health Crisis Intervention: Partnering with mental health professionals ensures non-violent emergencies are handled effectively and compassionately.

These measures not only cost less than facial recognition software or drones but also yield long-term benefits by addressing the root causes of crime.

Fiscal Responsibility is Key

El Cerrito’s financial challenges are no secret. Investing in high-cost technologies like facial recognition software and buying multiple drones would put unnecessary pressure on the city’s already strained budget. Instead, El Cerrito should allocate resources toward initiatives that improve public safety while respecting taxpayer dollars. Moving forward with these expenditures is not just unnecessary—it’s irresponsible.

Focus on What Matters

The city has an opportunity to prioritize smarter, more sustainable public safety solutions. By saying no to facial recognition software and multiple drone deployments, El Cerrito can redirect its efforts toward proactive, community-focused measures that enhance safety without compromising financial health.

#FiscalResponsibility #SmartPolicing #21stCenturyPolicing #CommunitySafety #NoToFacialRecognition #NoToDrones #ElCerrito