Did you know that two years ago, the El Cerrito City Council renewed the City Manager’s contract a full year before it was set to expire? This premature decision not only ignored her ongoing poor performance but also missed a crucial opportunity to bring in new leadership capable of making the tough decisions that our city desperately needs.

Now, as we approach another critical juncture, it seems the City Council is poised to make the same mistake again. With new members set to join the council soon, it would be only fair—and in the best interest of the residents—for the decision to renew or terminate the City Manager’s contract to be made by the newly elected representatives. After all, they are the ones who will be working closely with the City Manager and will be responsible for guiding our city through its current challenges.

Unfortunately, the current council members seem biased and are rushing to extend the City Manager’s contract before the new members are seated. This is a move that smacks of self-interest, as they have nothing to lose by securing the City Manager’s position before stepping down. But what about the residents of El Cerrito? We are the ones who have suffered from the City Manager’s ongoing poor performance.

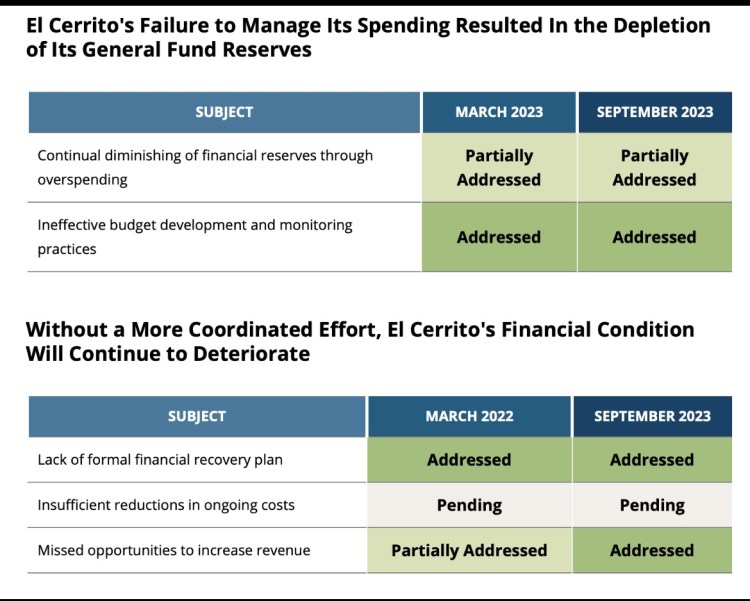

One of the most glaring failures under her leadership has been the chronic financial mismanagement that has left El Cerrito teetering on the brink of insolvency. Despite years of warnings and the city’s designation as one of the most financially distressed municipalities in California, there has been little to no effective action taken to reverse course. The City Manager has presided over mounting deficits, the depletion of reserves, and an increasing reliance on short-term fixes like sales tax hikes rather than addressing the root causes of our financial woes.

Additionally, her handling of the city’s unfunded pension liabilities has been woefully inadequate. With over $85 million in unfunded liabilities, El Cerrito is facing a fiscal time bomb, yet the City Manager has done little to mitigate this looming crisis. Instead, she has continued to support bloated administrative salaries and failed to implement meaningful cost containment measures.

Her lack of transparency has also been a major concern. Critical financial information is often obfuscated or delayed, leaving residents in the dark about the true state of the city’s finances. This lack of openness not only erodes trust but also hinders any real progress toward fiscal stability.

But it doesn’t stop there. The City Manager’s tenure has also been marred by ethical and professional lapses that should have disqualified her from holding such a critical position. The city recently had to settle a $544,000 sexual harassment claim, a situation that occurred under her watch, reflecting a severe lack of oversight and leadership. Moreover, she was caught on a hot mic yelling an expletive at a subordinate—a public display of unprofessionalism that further erodes confidence in her ability to lead effectively.

Extending her contract now, before the new council members can weigh in, is not just shortsighted—it’s irresponsible. This would have been the perfect time to part ways with a leader who has consistently failed to meet the needs of our community. Instead, we could have brought in someone new, someone with the vision and courage to make the difficult decisions required to turn things around.

Our city deserves better than a hasty decision made by a council that’s on its way out. We deserve leadership that is accountable to the people it serves, not leadership that is more concerned with protecting its own interests. It’s time for the El Cerrito City Council to put the needs of the residents first and allow the newly elected members to have a say in this important decision. Let’s not repeat the mistakes of the past. Let’s choose a path that leads to real change and a better future for El Cerrito.